The 7-Minute Rule for Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Things To Know Before You Get ThisThings about Eb5 Investment ImmigrationOur Eb5 Investment Immigration PDFsThe smart Trick of Eb5 Investment Immigration That Nobody is Talking AboutHow Eb5 Investment Immigration can Save You Time, Stress, and Money.

While we aim to offer exact and current web content, it should not be thought about legal guidance. Immigration legislations and regulations undergo alter, and private circumstances can vary commonly. For customized advice and lawful suggestions regarding your details immigration situation, we highly recommend speaking with a certified immigration lawyer that can offer you with customized aid and make sure compliance with current regulations and laws.

Citizenship, via investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 elsewhere (non-TEA areas). Congress has actually authorized these amounts for the next five years starting March 15, 2022.

To qualify for the EB-5 Visa, Financiers need to create 10 full time united state tasks within two years from the date of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Demand makes sure that financial investments add straight to the united state work market. This uses whether the jobs are produced directly by the company or indirectly under sponsorship of an assigned EB-5 Regional Facility like EB5 United

The Best Guide To Eb5 Investment Immigration

These jobs are identified via designs that utilize inputs such as advancement prices (e.g., construction and tools costs) or yearly earnings generated by recurring operations. In contrast, under the standalone, or direct, EB-5 Program, only direct, full time W-2 staff member placements within the industrial enterprise may be counted. A vital threat of depending exclusively on direct staff members is that staff reductions because of market conditions could cause not enough full-time placements, possibly resulting in USCIS rejection of the financier's petition if the task development requirement is not fulfilled.

The economic version then forecasts the number of straight jobs the new service is likely to produce based on its awaited revenues. Indirect work determined via economic designs refers to work produced in industries that supply the goods or solutions to the service straight associated with the project. These tasks are produced as an outcome of the boosted need for items, products, or solutions that support the business's operations.

Excitement About Eb5 Investment Immigration

An employment-based 5th choice category (EB-5) investment visa offers a method of becoming a long-term united state citizen for international nationals wanting to spend funding in the United States. In order to request this copyright, an international investor must spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Location") and develop or preserve a minimum of 10 permanent jobs for United States workers (omitting the financier and their prompt household).

This step has been a significant success. Today, 95% of all EB-5 funding is raised and invested by Regional Centers. Given that the 2008 monetary situation, accessibility to capital has actually been constricted and community budgets remain to face significant deficiencies. In many areas, EB-5 investments have filled the funding void, offering a new, vital resource of funding for neighborhood financial development projects that renew communities, create and support tasks, infrastructure, and solutions.

An Unbiased View of Eb5 Investment Immigration

employees. Additionally, the Congressional Spending Plan Office (CBO) racked up the program as earnings neutral, with administrative expenses paid for by candidate costs. EB5 Investment Immigration. More than 25 nations, consisting of Australia and the UK, usage similar programs to attract foreign investments. The American program is much more strict than lots of others, calling for substantial risk for financiers in regards to both their monetary investment and immigration standing.

Families and people who seek to relocate to the USA on an irreversible basis can get the EB-5 Immigrant Investor Program. The USA Citizenship and Immigration Services (U.S.C.I.S.) established out various needs to acquire permanent residency with the EB-5 visa program. The needs can be summarized as: The financier has to fulfill capital expense quantity demands; it is normally needed to make either a $800,000 or $1,050,000 funding investment quantity into a UNITED STATE

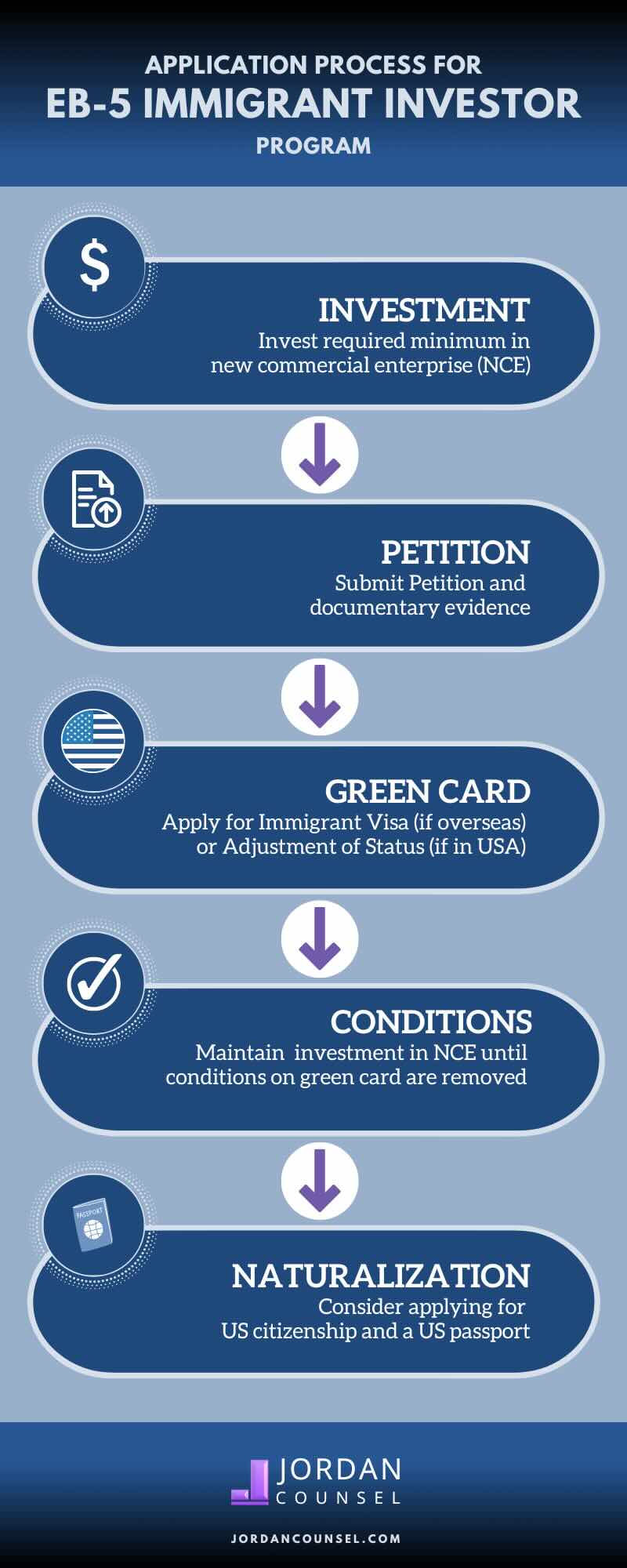

Speak with a Boston immigration lawyer about your demands. Here are the general actions to acquiring an EB-5 financier copyright: The primary step is to locate a qualifying financial investment possibility. This can be a brand-new business business, a local center task, or an existing organization that will certainly be expanded or reorganized.

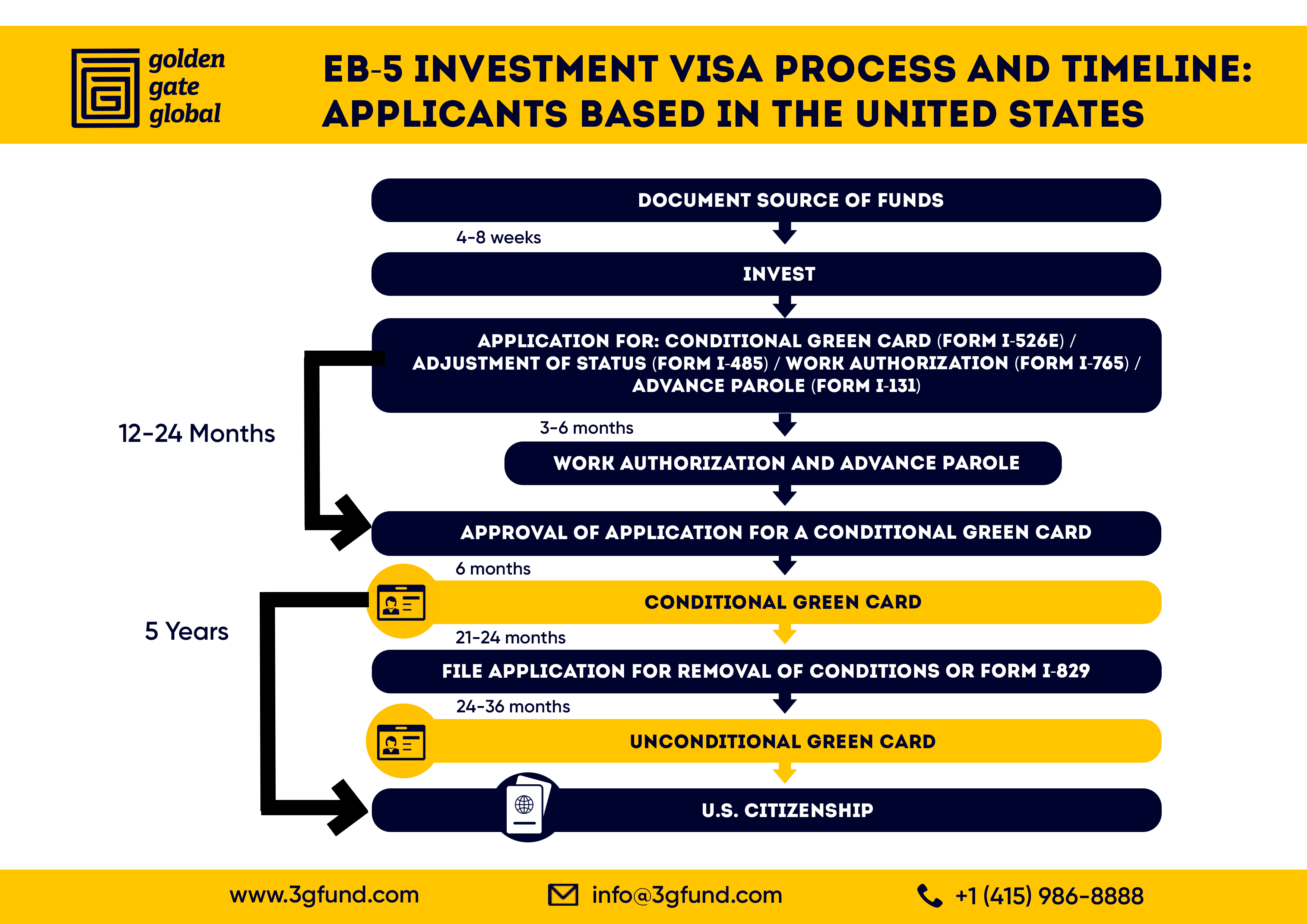

As soon as the chance has been recognized, the investor must make the financial investment and send an I-526 request to the united state Citizenship and Immigration Provider (USCIS). This petition should consist of evidence of the investment, such as financial institution declarations, acquisition agreements, and service strategies. The USCIS will certainly evaluate the I-526 request and either accept it or demand added evidence.

Some Known Facts About Eb5 Investment Immigration.

The financier should use for conditional residency by sending an I-485 request. This petition needs to be sent within 6 months click to find out more of the I-526 authorization and i loved this must consist of evidence that the financial investment was made and that it has produced at least 10 full-time work for U.S. workers. The USCIS will examine the I-485 petition and either accept it or demand additional evidence.